13 Apps that Support Mobile Payments and Credit Card Transactions

Regardless of what types of businesses you are running, offering mobile payment service to your customers is a must to make your business a success. This is because smartphones and tablet computers are the hottest commodity these days, almost everything can be done through mobile devices, from making phone calls, surfing net, listening music to playing games, online shopping, and of course, making payment.

The conventional credit card service requires merchants to set up a business account with bank and rent a card reader. On top of that sellers have to pay expensive setup fee, monthly fee as well as certain percentage of transaction charge on every sale they make. Today, with the presence of mobile payment processing apps, merchants can offer their customers multiple payment options including credit cards, debit cards and PayPal in a highly mobile, quick and easy way.

There are many mobile payment services on the market and choosing the right one to suit your business can be a challenge. Today we’ve rounded up 13 popular mobile payment processing solutions helping merchants like you to boost your business sales and conversion.

PayPal Here

While most of the mobile payment processing services only accept credit card transactions, PayPal Here gives your customers more payment options. With the app and credit card reader, your customers can pay by swiping credit card, debit card or using PayPal account. The beauty of this service is that customers can check in with your business and settle the payment by transferring PayPal fund to your account without credit card involved. Transaction fee wise, it costs 2.75% of the sale price and there’s no month fee or setup cost.

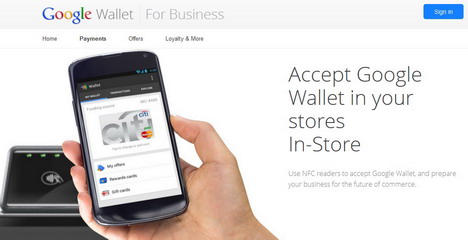

Google Wallet

This is one of the best payment services that enable merchants to accept both online and in-store payment through Near Field Communication (NFC). To accept in-store transactions, merchants can buy or rent NFC reader from First Data. Customers with Google Wallet app installed on their Android devices can scan the reader to make a payment conveniently. Google Wallet charges a normal card present fee for each transaction without additional monthly fee. If you’ve already used a payment processing service, you can either replace the service or integrate it with Google Wallet with no cost.

Intuit GoPayment

GoPayment is a great app for business owners who regularly need mobile payment processing. To use the app you’ll have to plug its free card reader into the audio jack of your iPhone or Android phones. Simply swipe your customer’s credit card and you’ll be able to collect the payment in seconds. Pricing wise, GoPayment offers 2 options to suit your needs. You can either choose 2.75% per swipe or go for $12.95 monthly fee with low rate of 1.75% per swipe. Another cool feature about this app is that it syncs perfectly with QuickBooks, desktop as well as point of sale helping you to better manage your business.

Boku

Boku is a mobile payment processing service that enables sellers to accept payment from customers using their cellphone numbers. Merchants can offer Boku as an additional payment option for their business, website and app to increase conversion. After customers pay for their purchases, the payment will be added directly to their phone bill. No bank account and registration are required.

Square

If you are looking for a basic mobile payment app with no monthly fee nor membership fee, Square is a good option you can consider. The app accepts credit card payments anywhere through your iPhone, iPad or Android based smartphones.

As mentioned Square don’t charge users monthly fee, but a 2.75% transaction fee is chargeable for every payment being made. In our opinion, the app is suitable for those who don’t require mobile payment processing regularly.

Paytoo

Paytoo is another mobile wallet that lets users to securely store money and transfer fund internationally without having a bank account or credit cards. The app has wide array of capabilities, it enables you to top-up prepaid cellphones anywhere in the world, directly deposit paycheck into account, create virtual credit cards, pay bills, make cash withdrawal and many more.

LevelUp

Instead of enabling customers to make a payment using NFC enabled credit cards, LevelUp allows customers to pay their purchases by scanning a quick response (QR) over its terminal. Customers can scan a QR code on their smartphone or get a LevelUp card to do so. The easy payment service has many great features that help merchants to improve their businesses such as creating a loyalty programs to attract more customers and having access to multiple analytics tools to keep track of customers’ purchases. LevelUp doesn’t charge transaction fee on both merchants and customers. Instead, merchants are charged for running marketing campaigns with the service.

ROAMpay

ROAMpay is another app that accepts mobile payment transforming your smart phone into point of sale device. The service’s 1.58% low transaction fee, easy-to-use features and high level of transaction security making it a great solution for mobile businesses of all sizes. The app also supports both online and offline processing to protect against lost wireless connectivity.

GlobalVCard

This is CSI’s virtual mobile wallet that enables users to create a secure single and multi-use MasterCard account numbers. Without the actual credit card, GlobalVCard users can conveniently make a payment for online and phone purchases, mail in payments and catalog purchases through smartphones or tablet devices. It’s a great solution for merchants to control their operating expenses.

MasterCard’s PayPass

PayPass allows you to make payment for your purchases easily and safely. You don’t have to swipe or dip your credit card, simply tap your NFC-enabled credit card or mobile devices over a point-of-sale terminal to instantly make a payment. For merchants, having a PayPass terminal in place allows them to accept various forms of payment from customers such as MasterCard, Google Wallet, ISIS Wallet, etc.

Visa’s payWave

Similar to MasterCard’s PayPass, Visa also has its own mobile payment processing service called payWave. It enables merchants to receive payments from customers who’re scanning their NFC enabled Visa card or smartphone over a POS terminal. Merchants don’t need to buy multiple NFC readers to cater different credit cards as most of the major credit card companies use the same radio frequency technology.

mPowa

mPowa is a cloud-based service that allows merchants to receive and manage payments from their smart phone while on the move. It enables businesses to transfer and receive payment in most of the major currencies and allows merchants to access hundreds of international banks and multiple payment services. With these advantages, mPowa is a great solution for those running online business.

ISIS

This is another payment processing service that transfers payment from mobile phone to payment terminal through NFC technology. To use the service, you need to buy or rent an NFC reader from ISIS’s partner. The good thing about this service is that it doesn’t charge any transaction fee on both merchants and customers.

Tags: business, mobile app, mobile payment, mobile phone, smartphone