10 New Mobile Payment Technology and Trends Explained

Mobile phones have been glued to our hands since their development and nowadays it seems as if mobile technology is slowly overpowering classical payment methods. It all started with the development of Apple Pay in 2014, and it’s been on the rise since. Today we have a big number of mobile wallets on the market and users can pick and choose the unique benefits that come with their choice.

Here are 10 newest mobile payment technology and trends that are most likely to cause a ripple in 2018:

1. Contactless Payments

First on the list, contactless payments technology is becoming increasingly popular. The way it works is miraculous and extremely simple-at least from the consumer perspective.

Let’s say you commonly use a mobile wallet, like Android Pay. All you need to do is fill in your credit card or other payment information in the wallet itself. The wallet will store it for the future and when you’re in a store that has mobile payment readers, you will be able to use your phone to pay.

How does it really work?

Well, the POS terminal which serves as a payment reader reads the payment information that is stored on the smart chip ingrained in your card and is thus able to process the transaction. The terminals emit a high frequency radio wave that allows for each chip to connect to an antenna, which in turn expedites the communication between the two.

What’s actually happening is that your phone is connecting to the POS terminal through a secure wireless communication protocol.

It’s amazing, fast and safe. No wonder it’s likely to become the preferred payment mode.

2. Near-Field Communication Payments

The principle of NFC payment is similar with that of the contactless one, with the main difference being the way the devices are connected.

With NFC payment you have two electronic devices which are interacting with one another- this would be your mobile phone and a reader. In this case, the reader will generate a RF field as an initiator and this field will power its target- which is your phone.

Of course, your phone already needs to have the payment information stored on it, and this is most commonly done with help from mobile wallet technology.

This payment method is very promising, especially in the US, where the adaptation of EMV security standards have aided in making NFC technology more present and almost universal.

3. Bluetooth Payments

Now, before you sign off at the bare mention of Bluetooth technology, considering it too simple- let me explain why it could really change the way things are done in the mobile payment industry.

While NFC technology is great and people are right to focus on it, it doesn’t change the fact that it requires two to be really close to each other (a few centimeters at most) in order to connect them and conduct the transaction.

As Bluetooth has a lager range (simple phones have a 9 meter range), it opens up a new world of opportunities. Using Bluetooth mobile payment technology could mean that paying doesn’t need to include taking your phone out.

And it’s not the only potential benefit of it- it’s slightly faster than NFC and allows for multiple simultaneous connections, which has the potential of speeding up the check-out process tenfold.

4. Usage of Mobile Wallets

Mobile wallets are turning more into lifestyle apps. This trend comes from China, where two thirds of purchases in 2016 were made through mobile payment, for the first time ever. It’s an extremely convenient method of payment, so it’s not surprising that millions of people are turning to it.

The usage of a mobile wallet is a prerequisite for any type of mobile payment, as there is no better or safer way to store your payment information.

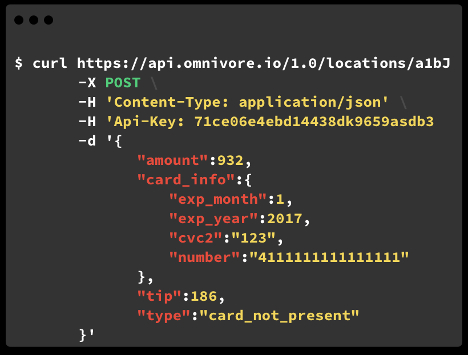

5. Payments Using Application Programming Interfaces (APIs)

Let’s start from what APIs are: if we’re talking about computer programing they’re a set of definitions and protocols used for building application software. In more general terms, they’re methods of communication between software components.

This ability to foster communication is what’s making them relevant in the mobile payment industry.

APIs are increasingly significant in Europe, where a new Payment Services Directive has been passed. This directive is set to allow account information service providers to access customer information using APIs, third person payment service providers to make payments using them and increase competition in financial services, among other things.

Not a small thing, all things considered.

6. Payments Everywhere

Research into Gen Z-driven trends, as they are projected to be 40% of all US consumers by 2021, reserves the place of trend number eight for payments everywhere. This trends showcases why mobile payment technology is a must-have: how else would you connect any two devices and transfer funds?

With mobile payment technology everyone can sell goods, and any device can accept the transaction. It’s astounding and simple, and it will transform the future.

7. Demand for Speed of Purchase

Gone are the days in which consumers were happy to wait a few days for their orders to be processed and delivered. In 2018, consumers want their products as fast as possible and they use their mobile phones to track the progress of things.

This shift onto mobile tech is present in the payment industry as well, because no one wants to be bothered with entering a PIN and waiting for the transaction to be processed when they could just hold their phone close to the terminal and pay in the matter of seconds.

It’s a busy world out there and technology needs to help us keep up with it.

8. The Rise of Digital Assistants

New mobile device personal assistants are plugged right into Google and are able to use its data to generate useful information for users.

That means than an app on the phone in my pocket can tell me when products similar to those I’ve purchased or those in my wish list are on sale, which deals are available and which new products I can look forward to.

This trend is also a good indicator of the dependency on our phones we’re developing, with each new useful feature.

9. Instant Payments

It started with instant food and entertainment and is moving towards the banking and payment industry. I’ve already addressed the fact that no one wants to wait anymore- so it comes to no surprise that instant payments are starting to be the new norm.

It’s just a matter of time when big companies will jump on the wagon and we’ll have one-click-payments everywhere.

10. Banks as Payment Platforms

In a bit to remain relevant, banks are teaming up with Fintech companies. They are predicted to move to a more platform based model of operations, so as they’re not left behind.

New users and Gen Z in particular, are showing a lot of tendency of switching between cards if they’re offered more rewards and benefits.

With the way banks are structured now, that constant need for change and improvement will not be accommodated- a fact banks are aware of and are taking decisive action to overcome.

These are the some of the current mobile payment technologies and trends in the industry. This overview will help you understand the basics of it and enable you to join the crowd on the way to technological advancement.

Tags: mobile phone, smartphone, technology