Best Practices for Crypto Wallets to Store Coins & Handle Keys

Wallets are crucial for anyone who invests in cryptocurrency, whether planning to actively trade, invest and wait for the price of the coin to rise or spend crypto at retailers that accept them. Simply using a wallet is not enough, however, so you must also follow best practices to keep your crypto secure. Otherwise, you risk losing funds.

How Bitcoin Exchanges Protect Themselves

Because you will have to store some of your cryptocurrency on a Bitcoin exchange at some point in time, you would find it useful to understand how these platforms protect themselves. Although the exact protections offered on a cryptocurrency exchange vary, they frequently include:

- Storing the majority of the funds (up to 98 or 99 percent) offline in cold storage

- Insuring funds in hot wallets

- Using various encryption methods

- Using hardware security modules

- Utilizing multi-signature storage

- Strongly encouraging users to opt for two-factor authentication

- Enforcing transaction, deposit, and/or withdrawal limits

Despite the various security measures in place on cryptocurrency exchanges, they are also common targets for hackers due to the potential rewards with just a single hack.

Exchange Platforms Do Not Offer Enough Protection

Because of the risks associated with the storage of cryptocurrency on an exchange, most crypto investors strongly suggest that you hold the majority of your funds in a wallet. They also suggest leaving only the coins you need for trading on the exchange as wallets tend to be more secure.

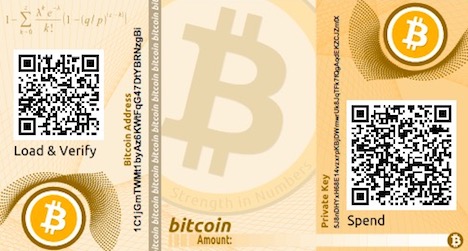

One of the most important factors that should compel you to use a cryptocurrency wallet instead of relying on the exchange is that you will control the public and private keys. If you use an exchange’s wallet, they remain in control of these keys, putting you at the mercy of their security strategies. If, however, you use a wallet, you have control.

Additionally, if you plan to invest in ICOs or make purchases using your cryptocurrency, you typically need to have the funds in a wallet, not on an exchange. In most cases, you can only use the funds on an exchange to trade for other cryptocurrencies, whereas any other functionality requires a wallet.

Comparing the Wallet Types – Web vs Software vs Hardware

Although some types of cryptocurrency wallets are more popular than others, there is a long list of varieties. Each type has its own advantages and disadvantages, allowing them to appeal to different users. Depending on your situation, you may also want to consider using a combination of wallet types for your cryptocurrency depending on how frequently you want to gain access to it. Take a closer look at some of these options for additional insight.

You access web-based (or hot) wallets via a web browser. Compared to other types of wallets, they are not as secure. Advantages include:

- Quick transactions

- Good for small quantities of cryptocurrency

- The ability to manage several cryptocurrencies

- The ability to make transfers between web wallets with ease

Disadvantages include:

- Susceptibility to insider hacking, malware, phishing scams, DDoS attacks, and more

- The third-party wallet holds the information

- Viruses and malware can infect your computer

While mobile wallets are similar to web wallets in that they rely on the internet to function, they work via your mobile device. Advantages include:

- Incredibly practical for daily use as your smartphone is always with you

- Extra features like QR scanning

- The ability to gain privacy via TOR networks

- Intuitive user interface

Unfortunately, mobile wallets build on the risks associated with web wallets, including:

- Susceptibility to viruses, keyloggers, and malware

- Phones are very insecure

Hardware (or Cold) Wallets are more secure than either of these options but less intuitive to use, although still simpler than paper wallets. Advantages include:

- Being the best method of securely storing cryptocurrency for a long term

- Typically having stronger security features

- Can store hundreds of cryptocurrencies and altcoins

Disadvantages include:

- Complicated for some beginners

- Requires purchasing the hardware

- Sometimes hard to find in stores but readily available online

As mentioned, you may want to combine your crypto storage across multiple types of wallets. For example, you can store cryptocurrency that you will not access for a long time in a hardware wallet, and the coins you plan to transfer or use in the near future in a mobile or web wallet.

Secure the Private Keys

Remember, a private key provides access to your cryptocurrency wallet. This means that if a hacker gets your private key, they can steal all the funds in that wallet, and because all crypto transactions are irreversible, you will not be able to get your money back. You can avoid this by taking extra precautions regarding your private keys. Do not share them with anyone and only store the key online or on a device that connects to the internet after encrypting it. Most software wallets offer encryption for your wallet file.

More Wallet Best Practices

One of the smartest things to do in terms of cryptocurrency wallet security is to limit the amount of funds stored there. Think of your crypto wallet in the same terms as the physical wallet you use for regular currency. You would not store a lot of cash in a standard wallet due to the risk of theft.

Other best practices include:

- Create a backup of your wallet

- Encrypt that backup

- Ensure the backup is not location-dependent

- Encrypt your wallet

- Use a strong password that you can remember

- Ensure software is always up-to-date

- Avoid accessing public wireless networks on devices with wallets

- Enable two-factor authentication

- Choose a highly-rated and reliable wallet

Although there is no foolproof way to ensure that hackers do not access your wallet, following all of these best practices will make the probability of that occurring insignificantly small.

Conclusion

Your cryptocurrency wallet protects your crypto funds but it can only provide the security you want if you make smart decisions. Limit the funds you keep on an exchange and divide your funds between offline cold storage wallets and online ones. With the proper safety precautions, your cryptocurrency funds should remain safe, thereby protecting your investment.

Tags: cryptocurrency, digital currency, digital wallet, tips & tricks